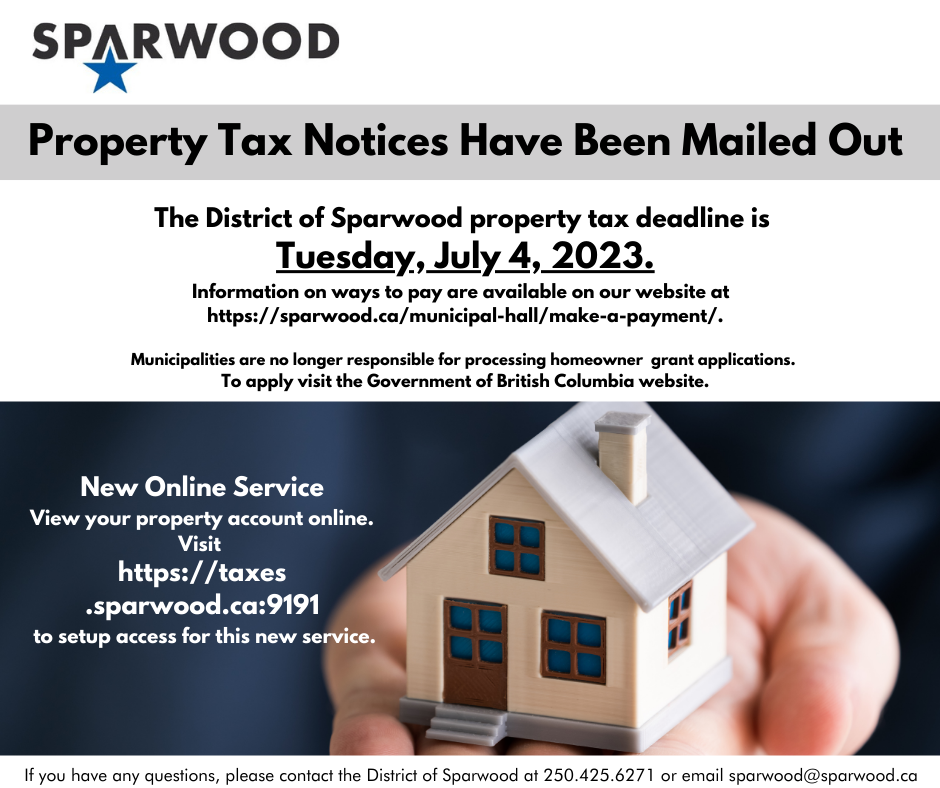

The 2023 Tax Notices have been mailed out. If you are a new owner and do not receive a tax notice by June 16, 2023, please contact the District Office to obtain a duplicate copy. Notices are mailed to the current owner shown on the Assessment Roll. Depending upon the date of purchase, the District may not have the new owner’s information and the tax notice will be mailed to the previous owner.

The deadline for paying your 2023 property taxes without penalty is Tuesday, July 4, 2023. If a financial institution is paying your property taxes through your mortgage, homeowners who qualify must still claim their Home Owner Grant. Failure to claim the Grant by the due date will result in a penalty. The Grant is a Provincial program.

For any further information regarding your Annual Property Taxes or ways to pay, please contact the District Office at 1-250-425-6271, email sparwood@sparwood.ca or visit our website at https://www.sparwood.ca/municipal-hall/budget-taxes/.

The Province of B.C.’s Homeowner Grant

All residential property owners must claim their 2023 grant with the Province in order for the grant to be applied to the balance owing on their Tax Notice.

How to apply?

You can:

- apply online at gov.bc.ca/homeownergrant

- call 1 888 355 2700, Monday to Friday 8.30am to 5pm

It is quick, easy, and secure – claim your grant online. Learn more here.

New Online Service

View your property account online. Click here to setup access for this new service.

Post Date: May 17, 2023 | Category: News & Updates